Strategy

- A unique approach to investments

- Team structure led by a proven top industry business leader and supported by top-notch financial expertise as well as a qualified advisory committee

- The Partners will invest in each acquisition

- Focus on strategic sectors FMCG & Consumer Healthcare in high growth geographies (predominantly Africa)

- High quality, small to mid-sized businesses either leader in their categories and markets or at early stage with substantial growth potential

- Vis Mundi will grow its portfolio companies into larger and stronger institutions through providing industry expertise at the strategic business level aimed at:

- Strengthening the inherent brand equity

- Expanding geographically and/or portfolio mix to realize larger critical mass

- Integrating vertically and horizontally

- Implementing or enhancing corporate governance

- Vis Mundi will take majority or significant minority stakes with strong protection rights and/or management rights

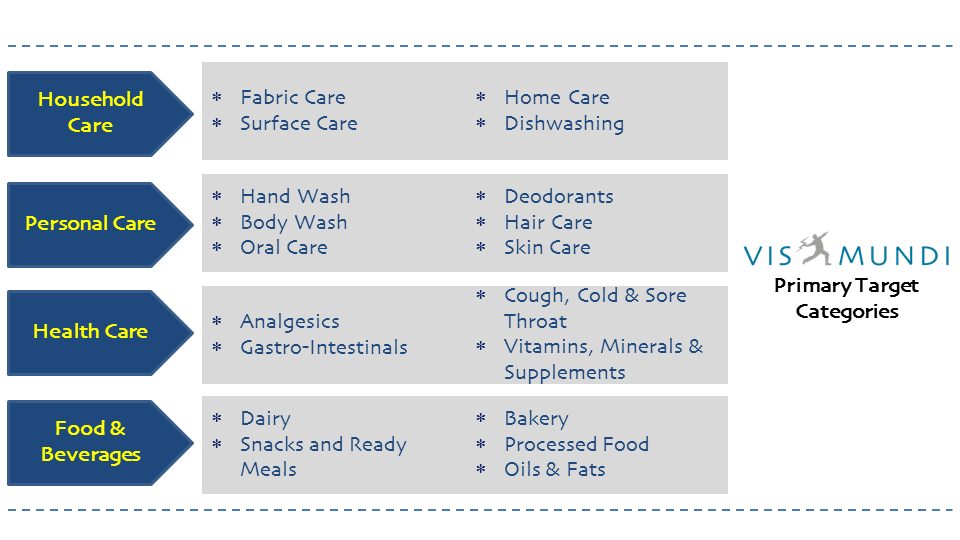

Sectors

- FMCG (Fast Moving Consumer Goods) and Consumer Healthcare

- Lower risk, Lower volatility exposure, High Growth, High Volume, High Margin, High Cash Generative categories

Geographies

Vis Mundi will be primarily sourcing investments in Africa and selected emerging markets, fueled by the following main drivers:

- Massive growth potential enhanced by an underdeveloped consumer market

- Strong demand prospects driven by growth in population (by 2050 Africa population will double exceeding 2 billion inhabitants, surpassing both China and India) and wealth (GDP per capita and disposable income)

- Strong local targets with significant branding upside and local/regional growth potential

- Local businesses are family run with limited brand expertise and unstructured succession planning

- Increasingly favorable regulatory environment aimed at encouraging FDIs

According to leading economists, Africa can become the new “force of the world” in the next 3 decades

Competencies

- A demonstrated ability to add value to our portfolio companies on the strategic, operational and commercial levels

- An industry specialized and regionally focused team, centered around building and growing the target investment companies, by creating long term sustainable and recognizable consumer brand assets

- In-depth knowledge of the region allowing the firm to assist its portfolio companies in growing organically, through bolt-on acquisitions, partnerships and joint ventures

- A strong existing network of strategic partners with a proven ability to providing market access, intelligence and connections

2014 © Vis Mundi. ALL Rights Reserved. Disclaimer| Developed byTagipedia